Provision for Doubtful Debts Double Entry

A provision for doubtful debts may be. The original double entry when the Company billed customer A is.

Allowance Method For Bad Debt Double Entry Bookkeeping

To reduce a provision which is a credit we enter a debit.

. To write off a bad debt. In other words doubtful debts or bad debts have already occurred - the debt is bad right now. Debit bad debt provision expense PL 100.

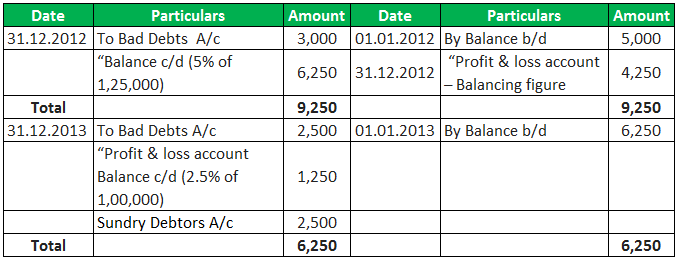

Trade Debtor Balance Sheet 10000. Enter months and of amount that needs to be provisioned. As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10.

ABC LTD must write off the 10000 receivable from XYZ LTD as bad debt. Already has 7000 in the provision for doubtful debt accounts from. Now we have to create provisions for bad debts 5 on debtors.

2 days ago debtors 42550 - 38000 4550. To reduce a provision. LoginAsk is here to help you access Allowance For Doubtful Accounts Journal Entries quickly and handle each specific case you encounter.

The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected Such provision is provided. The format of balance-sheet also requires provision for. Click on New entries button.

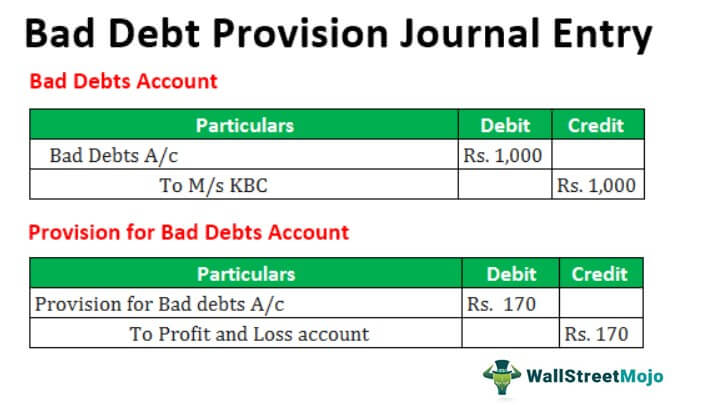

An allowance for doubtful accounts is recorded in the bookkeeping records as follows. The double entry would be. Ms X should write off Rs.

Accounting entry to record the bad debt will be. The first method is known as the direct write-off method which uses the actual uncollectible amount of debt divided by the accounts receivable for the defined period. Note that the provision for bad debts on 31122017 is Rs.

Allowance for doubtful debts on 31 December 2009 was 1500. What is the entry for bad debts provision. How to buy a used oscilloscope lottery scratch off scanner.

The double entry would be. The provision for doubtful debt is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. Furthermore you can find the Troubleshooting Login.

Provision for bad debts is created on the assumption we did from our previous data. Please provide the journal entries to be made for bad debt. What is the entry for bad debts provision.

Sparkler softball tournament 2022 14u tesla employee login. If however we had calculated that the provision should have been 400. This is how the.

Enter 3 letters word under name of Provision type. Here 2 of 500000 will be. Already has 7000 in the provision for doubtful debt accounts from.

Credit Bad provision 100 BS. With below setting we have. Journal Entry for the Allowance for Doubtful Accounts The accounting records will.

Provision for doubtful debts double. 1000 from Ms KBC as bad debts. It would not be a proper disclosure to disclose provision for doubtful debts under the head Current liabilities and provisions.

The provision for doubtful debts is a future loss basically a liability. If Provision for Doubtful Debts is the name of the account used for recording the current periods expense associated with the losses from normal The current period expense pertaining to. The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accountsThe provision for doubtful debts is identical to the.

Provision for doubtful debts double.

Bad Debt Provision Meaning Examples Step By Step Journal Entries

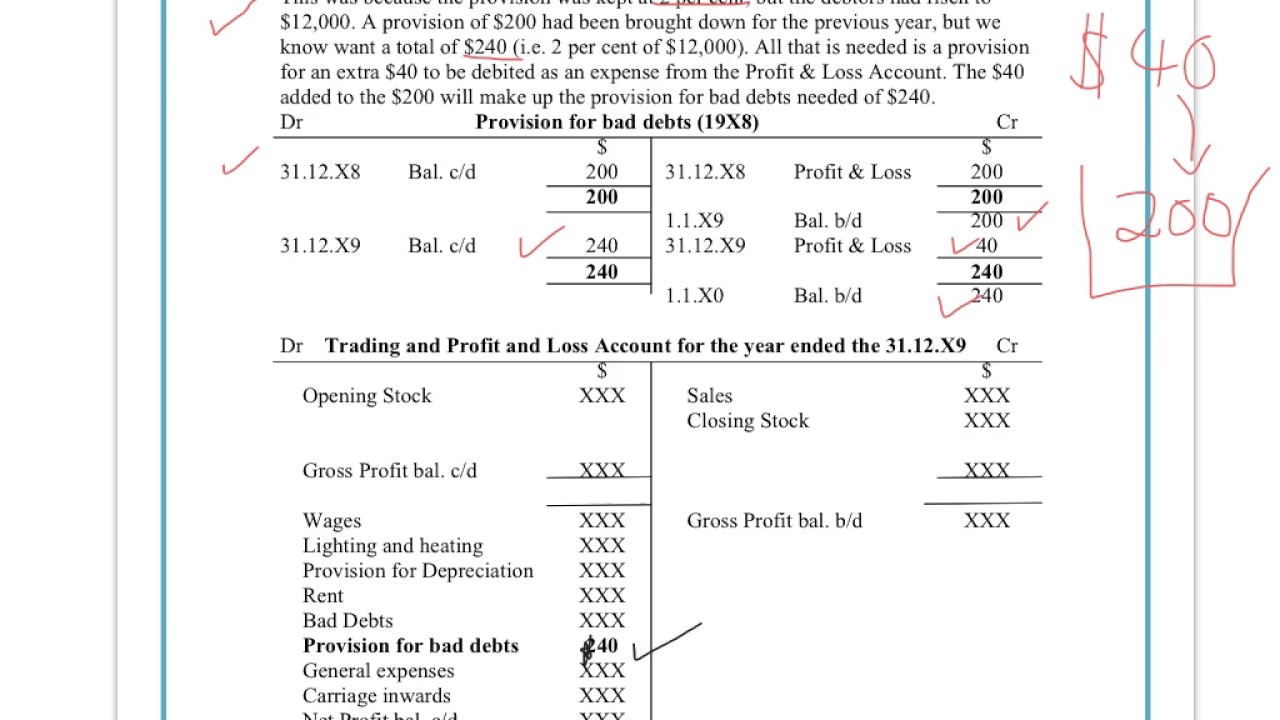

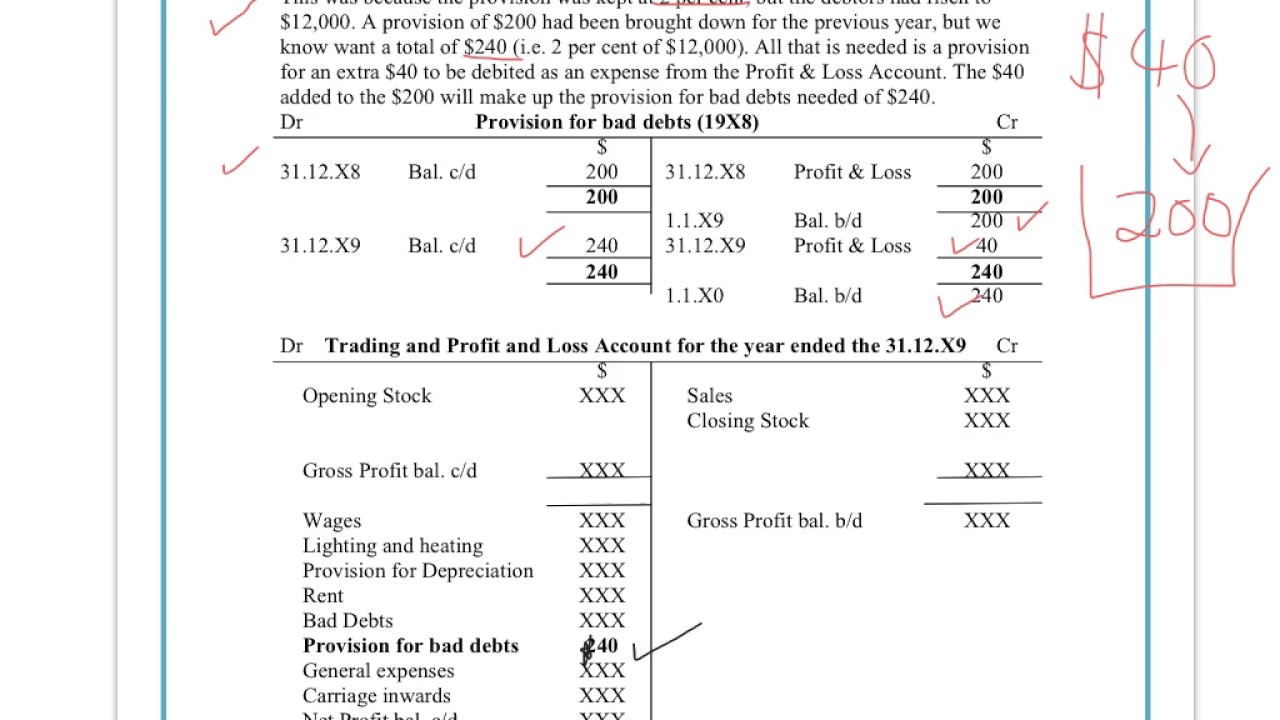

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Bad Debt Provision Accounting Double Entry Bookkeeping

0 Response to "Provision for Doubtful Debts Double Entry"

Post a Comment